Free Advice On Selecting Forex Trading Websites

Wiki Article

Ten Tips To Gain A Better Understanding The Market And Strategies For Trading Forex Online

If you are considering trading Forex online Here are 10 great suggestions on how you can increase your understanding of markets and develop a strategy. These are the 10 most important tips you should consider when trading Forex on-line: 1.

Understanding Economic Indicators

In Forex economic indicators (such as the growth rate of GDP and employment reports) are vital since they indicate the state of a country's economy. As an example strong employment figures from the U.S. usually strengthen the USD. To stay up-to-date on important announcements that could impact the currency pair, get familiar with an economic calendar.

2. Concentrate on Risk management

Set up risk management strategies right from the start. Set stop-loss levels and take-profit amounts to protect your investment from excessive losses. A lot of experienced traders advise only risking a tiny percentage of your account (e.g. between 1-2 percent) for each trade.

3. Be Careful When Using Leverage

Leverage is an effective instrument that can increase profits and losses. So use it wisely. Although brokers offer high leverage, you should start with lower leverage. This will help you understand the market better and how leverage can affect your positions. Over-leveraging is the leading mistake that can cause significant losses.

4. Trade Plan

A well-planned strategy for trading can help to keep you on track. Determine your goals in trading including entry and exit points, and risk tolerance. It is important to decide on the strategies you will implemented, as well as whether or not you want to utilize fundamental analysis, technical analysis, or both.

5. Learn the fundamentals of technical Analysis

Knowing the technical aspects of Forex trading is vital. Familiarize you with trendlines, support and resistance level, moving averages, and candlestick pattern. These tools are useful for discovering potential trading opportunities and directing entry and exit factors efficiently.

6. Stay informed on Global News

Natural disasters, central bank policies, trade agreements and political events could all affect market for currencies. For instance, an unanticipated reduction in interest rates from a bank could reduce the value of its currency. Being informed about global news helps you anticipate possible market movements.

7. How to Choose the Right Currency Pairs

For novices, some currency pairs like EUR/USD GBP/USD USD/JPY work better due to their greater liquidity and stability. Although exotic currencies can sometimes provide high returns, are also more volatile and riskier. Knowing the differences can help you choose the best currency pairs that fit your style of trading and the risk level you are comfortable with.

8. Demo account first.

Use a demo trading account to practice and practice your strategies before you start trading live. This can help you build confidence and validate your trading strategy in a secure, risk-free environment.

9. Examine the central bank's interest rates and policies

Central banks affect the value of currencies by setting the rate of interest, monetary policy and other factors. Higher interest rates can increase foreign investment in a currency, and consequently boost its value, while rates that are lower can weaken the value of a currency. The Federal Reserve, European Central Bank and other central banks make choices that can have a significant influence on the direction of currency.

10. Keep a Journal of Your Trades

A detailed journal of your trading can help you keep track of your trading and identify your strengths as well as weaknesses. Record every trade's entry and departure points, the reasons of the trade as well as the outcome. Through analyzing this data on a a regular basis you will be able to identify patterns in your trading and develop your strategies as time goes by.

The success of Forex trading depends on thorough knowledge of the market as well as strategic plan and well-organized execution. Be aware and take control of your risks. Adapt strategies as market conditions change. Take a look at the best https://th.roboforex.com/ for website examples including best forex broker in usa, best forex trading app, forex trading demo account, forex trading forex trading, app forex trading, forex trading, best forex broker in usa, fbs review, forex broker, fx trading platform and more.

The Top 10 Tips To Take Into Consideration When Trading Online For Forex: Technical And Fundamental Analysis

Fundamental and technical analysis play vital roles in Forex Trading. You'll be able to make informed and strategically sound choices when you're adept at both. Here are 10 top tips on how to use fundamental and technical analysis in trading online Forex trading.

1. Determine the most important resistance and support levels

Zones of resistance and support are price zones that determine when a currencies often stop or reverses. These levels function as psychological barriers, making them vital for planning entries and exits. Try to recognize these zones to understand where the price could reverse or even break out.

2. Multi-timeframes offer a wider perspective

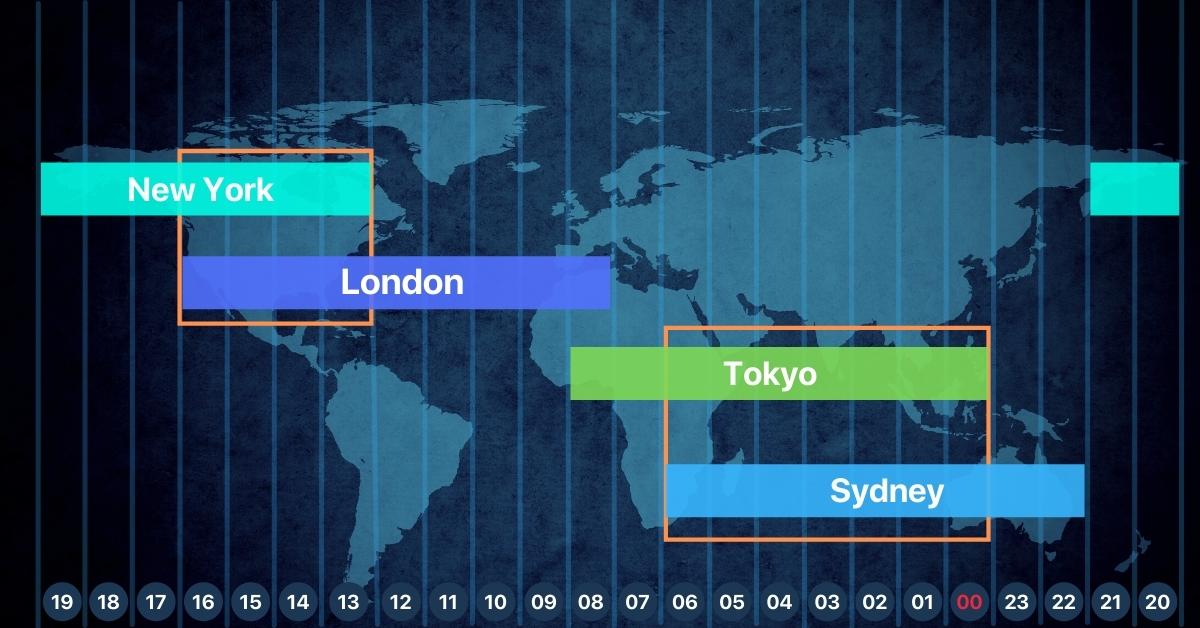

Different timeframes such as the daily, four-hour and one-hour charts are able to be used to gain insight into larger and longer-term trends. The higher timeframes provide a broad picture of the market while the lower ones provide information on timing and specific entry points.

3. Master Key Indicators

Moving averages and Moving Average Convergence Divergence, or MACD Three of the most important Forex indicators. Learn the functions of each indicator and how to combine them for better accuracy.

4. Pay Attention to Candlestick Patterns

Candlestick patterns such as dojis, hammers, or engulfings patterns are often a sign of potential reverses. Be familiar with these patterns to identify possible changes in price action. Combining candlesticks analysis with other instruments like support/resistance, and resistance/support, will help to enhance your timing.

5. Trend analysis can give directional clues

Moving-averages and trendlines can be used to identify markets in uptrends, sideways or downtrends. Forex traders are often enticed to trade in the direction the trend is heading. This approach produces consistent outcomes. Avoid counter-trend trading unless you are at a high level of expertise.

Fundamental Analysis Tips

6. Understanding Central Bank Policy and Interest Rates

Central banks, including the Federal Reserve Bank or the European Central Bank (ECB) manage interest rates which have an direct impact on the value of currencies. Higher interest rates tend to strengthen a currency, and lower rates could make it weaker. Be aware of central bank announcements because they can trigger big market moves.

7. Follow the Economic Indicators and Reports

Economic indicators that are crucial to the economy, like GDP and unemployment rates, inflation, and consumer confidence, provide insight into a country's economic well-being and affect the currency's value. Stay informed of the most recent economic news and assess how they impact the currency pairs you have.

8. Geopolitical Events and News to Analyze

The market for currencies can be affected negatively by events such as elections or trade negotiations. Stay up-to-date on the latest global news and events particularly those that impact major economies such America, Eurozone, China. Be prepared for volatility by adjusting your strategy to abrupt geopolitical changes.

Combining Fundamental and Technical Analysis

9. Aligning Technical Signals with Fundamental Events

Combining the analysis of technical and fundamental analysis can boost the process of making decisions. For example, if the technical data shows an uptrend and a positive economic report is anticipated, both factors can confirm a stronger buy signal. By combining both strategies, you can reduce uncertainty and increase the likelihood of the success.

10. Utilize risky events as trading opportunities

Volatility is often caused by significant events like Federal Reserve meetings and non-farm payroll releases (NFP). This could lead to rapid price changes. Since they can be unpredictable, many traders will avoid trading during these periods. If you've had experience however, you could benefit from the price movements by using analytical techniques. Be cautious, make sure you set strict Stop loss orders, and prepare to react quickly.

Forex trading is a mixture of technical and analytical analysis. This helps traders gain full understanding of how the markets are moving. When they master these strategies traders are able to better navigate the markets for currency and make better strategic choices, and improve overall performance. See the best for more examples including foreign exchange trading online, best forex brokers, fx trade, app forex trading, united states forex brokers, forex and trading, forex trading brokers list, forex best trading app, top forex trading apps, foreign exchange trading online and more.

Ten Suggestions For Improving Your Forex Trading Abilities And Demo Trading.

Demo trading is a great opportunity to build your knowledge before you trade with real money. Here are 10 tips on how to improve your Forex trading skill and maximize your demo account experience.

Treat Your Demo Account Like a Real Account

1. If you'd like to get the most benefit from demo trading, you must approach it with the same seriousness like you would on a real account. To maximize the benefits of demo trading, approach it with the same seriousness as you would with a live account. This includes setting risk limitations making sure you plan trades with care and managing your positions as if your cash was on the line. It helps develop solid trading habits that which can be transferred into real-time trading.

2. Develop and test a trading plan

Use the demo account to create an effective trading strategy, which includes exit and entry strategies, risk-management rules and sizing your position. Try your plan on various trades and conditions. The results will help you refine the plan and create a consistent strategy.

3. Learn How To Use The Trading Platform

Get familiar with the features of the trading platform, such as charting tools and the different types of orders. Also, get familiar with the risk management settings. This will help you become more confident, and reduce the chance of errors when you start trading in real-time.

4. Explore Different Trading Strategies

Demo accounts provide a risk-free environment to try out different strategies (like day trading, swing trading, or trend following) and see what best suits your needs. Experiment with each approach to learn about its strengths, weaknesses, and suitability with your trading style and timetable.

5. Practice Risk-Management Techniques

Make use of your demo account to test creating stop-losses, choosing appropriate position sizes, and using leverage responsibly. For long-term success it is important to understand risk management. So, practice until the art of managing risk becomes second-nature.

6. Keep track of your trades and analyze them

Keep a meticulous record of your trading activities. Include reasons for entering and exiting, the outcome of every trade and the emotions you experienced during the transaction. Reviewing and analyzing your journal will allow you to determine areas where your plan can be enhanced.

7. Simulate the Real Market Conditions

Try to replicate the kinds of trades and leverage you'll be using on your account. Don't trade in excessive quantities or in large positions, as these are not representative of the risks you face when using your personal funds.

8. Try to test your skills under different market Conditions

Forex is different depending on the circumstances (trending vs. range vs. turbulent versus tranquil). Use your demo account to test your strategy in different environments, like high-impact news events or low-volatility times. Then, you can prepare yourself to trade in different scenarios.

9. Gradually Increase Complexity

Begin with simple methods or indicators that are basic before using more sophisticated tools or multiple timeframes. Develop your knowledge and skills slowly. This approach allows you to learn the basics and then explore more complex strategies.

10. Set a Demo Trading Limit

Demo trading is a must but don't remain there too long. If you feel confident about your trading strategy and consistently profitable, you should consider moving to an actual account. Demo trading is not a good way to simulate the emotions and psychological aspects of real trading. Therefore, only make the change when you're prepared.

By following these tips you can get the most out of your demo trading experience. You'll develop efficient trading strategies and establish the foundation for success in the future. Focus on consistency and constant advancement. Take a look at the top https://th.roboforex.com/beginners/info/national-holidays/ for blog recommendations including currency trading demo account, currency trading demo account, united states forex brokers, forex demo account, fx trade, forex and trading, forex trading trading, forex broker platform, forex trading brokers list, foreign exchange trading online and more.