New Ideas For Picking RSI Divergence Trading

Wiki Article

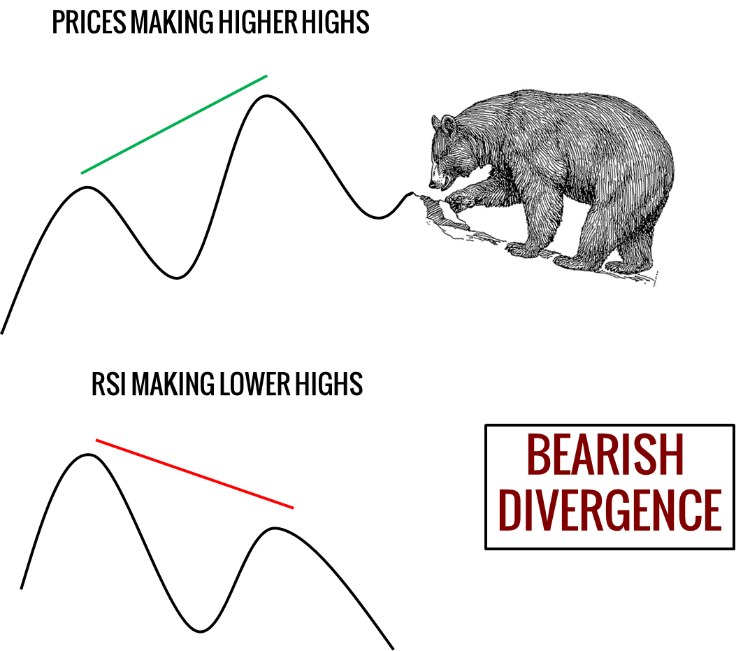

Okay, let's begin by asking the obvious question and find out what RSI Divergence is and what trading signals we can derive from it.|Okay, let's start with the obvious question. Let's find out the meaning behind what RSI Divergence means and what trading signals it could offer.|Let's start with the most obvious question. We'll look into the definition of RSI Divergence actually is and what trading insights we can get from it.|Okay, let's begin with the most obvious question. We'll look into the meaning behind RSI Divergence really is and the trading signals we can take away from it.|Let's start with the obvious question. Now, let us explore what RSI Divergence looks like and the trading signals that can be drawn from it.} If your price action and RSI indicator is not in sync on the chart, then there is a divergence. In an economy that is in a downtrend in which the price action is making lower lows while the RSI indicator has lower lows. A divergence happens when the indicator is not in agreement with the price action. When this happens it is crucial to keep an eye on the market. The chart shows that both the bullish RSI diversgence and bearish RSI divergence are clearly evident. In fact, the price action reversed after the two RSI Divergence signals. Let's discuss one last subject before we move into the exciting topic. Read the most popular automated trading platform for more examples including backtesting, trading platform, automated trading, trading divergences, crypto backtesting, trading platform, automated trading platform, automated trading platform, crypto trading backtesting, trading divergences and more.

How Do You Assess Rsi Diversgence?

We employ RSI to determine trends that are reversing. Therefore, it is crucial to identify the most appropriate one.

How Do You Detect Rsi Divergence When Trading Forex

At the beginning of the uptrend, both RSI indicator and Price Action did the same similar thing, forming higher highs. This is usually a sign that the trend is robust. But at the trend's end the price reached higher highs while the RSI indicator had lower highs. This is a signal that something is worth watching on this chart. In this case, we must pay particular attention to the market, since both the indicator's price action and the indicator are not in of sync. This indicates that there is an RSI divergence. The RSI divergence in this instance suggests a trend that is bearish. Take a look at the chart and observe what transpired following the RSI split. The RSI Divergence is extremely specific in identifying trends that reverse. The question ishow do you spot an underlying trend? Let's discuss 4 trade entry strategies that provide greater chances of entry when used in conjunction with RSI divergence. Have a look at the best automated trading software for website advice including forex backtesting, bot for crypto trading, divergence trading forex, forex backtesting software, automated cryptocurrency trading, RSI divergence cheat sheet, trading platform crypto, automated forex trading, forex backtesting software, trading platform and more.

Tip #1 – Combining RSI Divergence and the Triangle Pattern

Triangle chart patterns is a pattern that can be utilized in two different ways. The first is the pattern known as the Ascending Triangle. It is a good choice as a reversal pattern during a downtrend. The second is the descending triangular pattern, that is utilized in uptrend markets as an opportunity to reverse. The chart below illustrates the downward Triangle pattern. Like the previous example above, the market was initially in an uptrend before the price began to fall. At the same time, RSI also signals the divergence. These indicators indicate the weaknesses in this trend. Now we know that the current uptrend has lost momentum. As a as a result, the price eventually formed an descending triangle. This even confirms the reverse. Now is the time to start short-term trading. The methods used to break out for this trade were the same as those used previously mentioned. We will now examine the third entry strategy to trade. This time, we'll mix trend structure and RSI diversgence. Learn to trade RSI Divergence whenever trend structure shifts. View the best trading platforms for website info including automated trading software, automated trading software, trading platform, stop loss, bot for crypto trading, backtesting, RSI divergence, trading divergences, automated trading, automated cryptocurrency trading and more.

Tip #2 – Combining RSI Divergence and the Head and Shoulders Pattern

RSI diversification is an effective instrument for traders in forex to identify market reversals. So what if we combined RSI divergence with other reversal factors like the Head and Shoulders pattern? We can boost the likelihood of our trade, That is great, right? Let's explore how to make the right timing trades with RSI divergence and the head-shoulders pattern. Related to: How to Trade the Head and Shoulders Pattern in Forex. A Reversal Trading Method. Before you can trade, it is important that you have an enticing market. Since we are looking for the possibility of a trend reversal, it is preferential to have a market that is trending. Take a look at this chart. Read the top automated trading platform for site tips including backtesting tool, best forex trading platform, backtesting strategies, backtesting, automated cryptocurrency trading, automated crypto trading, stop loss, trading platform crypto, position sizing calculator, backtesting and more.

Tip #3 – Combining RSI divergence and the trend structure

Trends are our friends, isn't it! The trend is our friend, so long that it's trending. We must trade in its direction. This is how professional traders instruct us. But the trend isn't going forever, at the point where it will begin to reverse, isn't it? Let's look at trend structure and RSI divergence to determine how we can identify those reverses early. As we know, uptrends are making higher highs, while downtrends form lower lows. The chart below illustrates this point. The chart's left side displays the downtrend with an array of highs and lows. Then, take a take a look at the RSI divergence that is highlighted in the chart (Red Line). Price action can create Lows and Highs, however the RSI can create higher lows. What can this mean? While the market is creating low RSI it is actually doing the opposite. This indicates that a downward trend might be losing momentum. Check out the top rated crypto backtesting for more advice including best crypto trading platform, backtester, forex tester, forex backtesting software, backtesting, trading platform cryptocurrency, divergence trading forex, forex backtesting, software for automated trading, RSI divergence cheat sheet and more.

Tip #4 – Combining Rsi Divergence In Combination With The Double Top & Double Bottom

Double bottom or double top is a pattern of reversal that develops following an extended movement or after an established trend. The double top is formed when a level of price is not able to be broken. Once that level is reached, the price will retrace some distance before returning to the level it was at. If it bounces back to this level, you'll have a DOUBLE top. Check out the double top. It is evident in the double top that both tops were formed after a strong movement. The second top was unable to break above its predecessor. This indicates reverse. It's telling buyers that they struggle to keep climbing higher. Double bottoms use the same principles, but in a different manner. We will apply the method of entry using breakouts. This is the place we employ the breakout entry technique. We sell when the price is below the trigger. We recouped our profits after the price fell to below the trigger line. QUICK PROFIT. It is also possible to use the same strategies for trading the double bottom. The graph below illustrates the best way to trade RSI Divergence using Double Bottom.

Keep in mind that this isn't the only strategy that works for all traders. There is no one perfect trading strategy. Every trading strategy has losses and they are inevitable. Although we make consistent profits with this trading strategy but, we do are able to implement a rigorous risk management system and a quick way to reduce the losses. We are able to reduce the drawdown while also opening up new the possibility of a great upside.